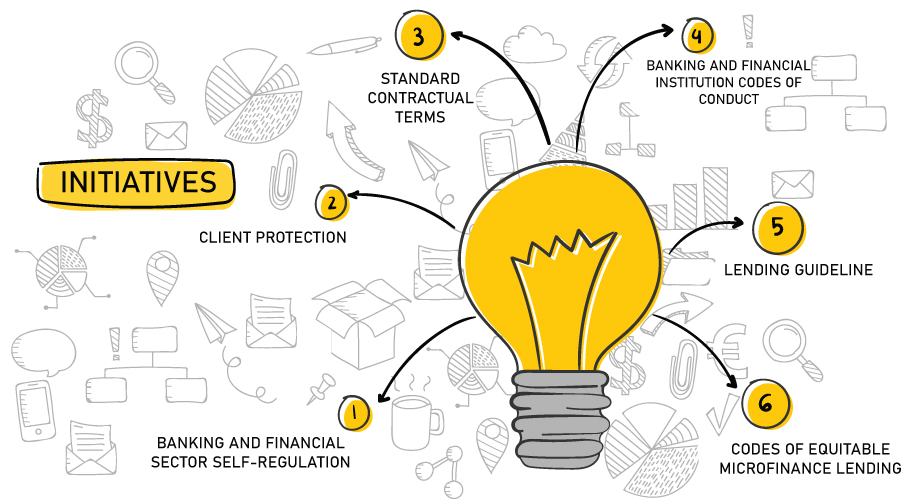

Banking and Financial Institution Codes of Conduct

The objectives of this codes are: The rules of governing key terms of Standard Loan Contract are in the following: a) To promote effective, reliable, accountable and responsible banking and financial practices by setting business operation standards for the Banking and Financial Institutions to follow and execute b) To increase transparency so that Consumers can have a better understanding of what they can reasonably expect from the services provided. c) To build a fair and professional relationship between Consumers and the Banking and Financial Institutions based on the principles of equity and equality. d) To foster confidence in the banking and financial system; and e) To encourage a corporate culture of fair dealing and competition This code applies to all members of the Association of Banks in Cambodia, Cambodia Microfinance Association, and Cambodia Association Fintech & Technology. These codes of conduct covered 21 standards for BFI and Fintech company to follow. More details, please download from the following link:

Read More