ឧបសម្ព័ន្ធ ២ ការគោរពគោលការណ៍ការពារបរិស្ថាន សង្គម និងអភិ...

ធនាគារ/គ្រឹះស្ថាន ទទួលស្គាល់ពីតួនាទី និងការទទួលខុសត្រូវរបស់ខ្លួន ក្នុងកិច្ចការពារភពផែនដី និងបរិស្ថានបានល្អប្រសើរ និងភាពចំបាច់បំផុត ក្នុងការអនុវត្តទៅតា...

Read more

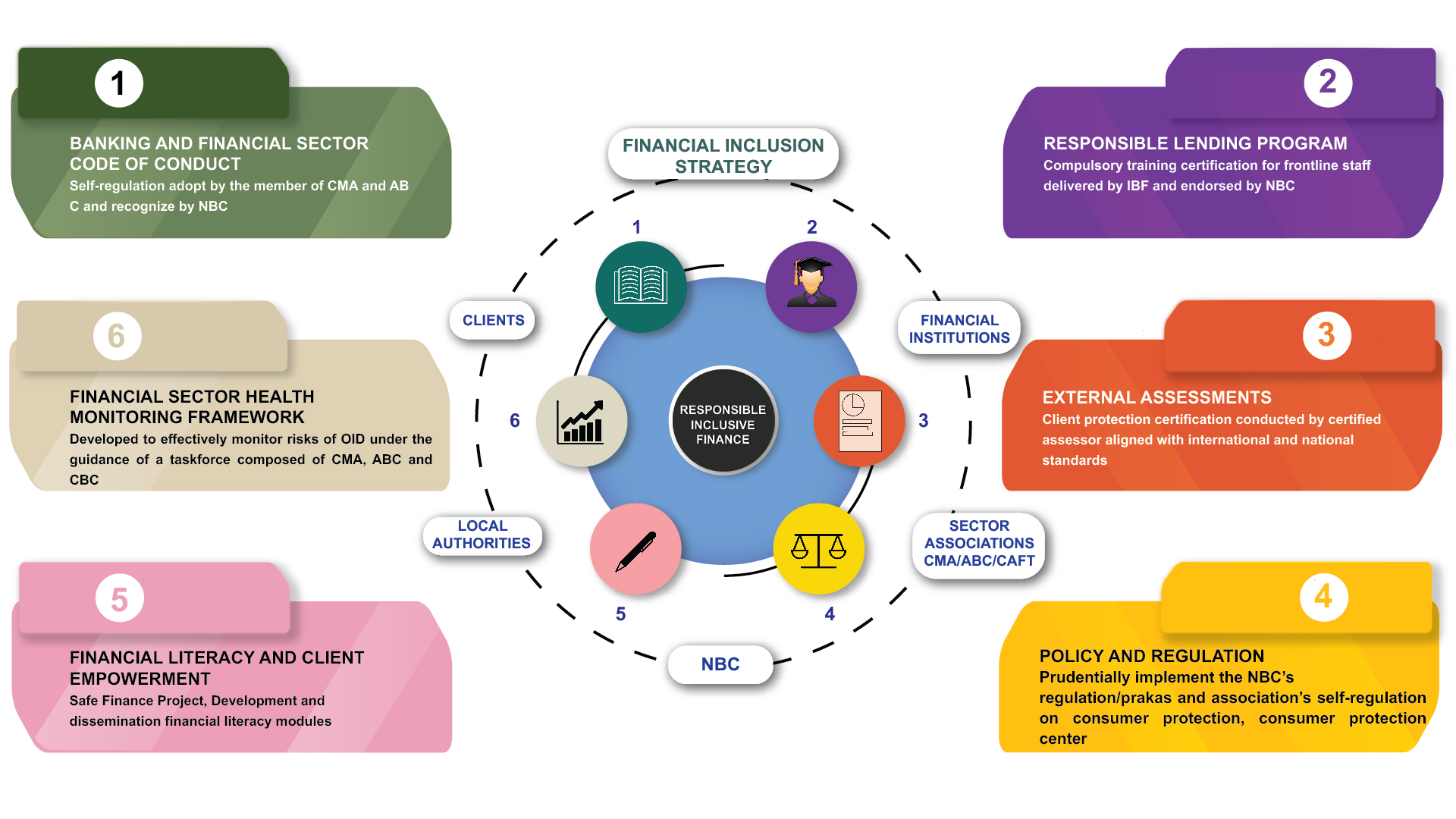

CMA’s Department of Financial Inclusion and Social Impact is a specialized division that focuses on promoting financial inclusion and driving positive social impact within the microfinance sector in Cambodia. With a mission to create an inclusive financial system that serves all segments of society, the department plays a crucial role in advancing the microfinance industry's social and developmental objectives. CMA’s 2022-2026 Strategic Plan tasks the department to focus on “Strengthening the resilience and sustainability of members and microfinance sector” which primarily focus as follow:

Improve Responsible Financial Inclusion and Consumer Empowerment in Alignment to the National Financial Inclusion Strategy 2019- 2025

The initiative aims to protect and empower consumers while providing fair and transparent financial services. By preventing abusive practices and establishing consumer protection measures, we safeguard clients from risks associated with predatory lending, over-indebtedness, and unfair collection practices. Additionally, promoting consumer empowerment through financial education and financial literacy ensures that individuals can make informed decisions, access suitable financial products, and understand their rights and responsibilities. This initiative builds trust, credibility, and sustainable growth in the sector while aligning with national strategies.

Establish a CMA Research Program That Will Focus on Data Collection, Storage, and Analysis and Disseminate Through the Financial Sectoral Monitoring Framework

The establishment of a research program within CMA aims to collect, store, and analyze data to generate valuable insights and information about the microfinance sector. The comprehensive data collection will enable CMA to understand the sector better, identify emerging challenges, and make informed decisions to support its members by extracting meaningful insights and trends which will allow CMA to identify patterns, assess risks, and uncover opportunities.

Strengthen New Initiatives and Programs to Improve Business Continuity, Digitalization and Sustainable Green Finance Programs

This focus reflects the recognition of the importance of these areas for the long-term resilience, efficiency, and sustainable development of microfinance institutions. CMA’s efforts are to support members in enhancing their business continuity strategies, including the development of contingency plans, risk management frameworks, and disaster recovery mechanisms to ensure uninterrupted financial services provision. More than this, there is a need for the members to accelerate digitalization, leveraging technology to improve operational efficiency, streamline processes, and expand financial inclusion. Embracing digital solutions like mobile banking, online platforms, and digital payment systems will enable wider client reach, cost reduction, and enhanced service delivery.

Lastly, the promotion of sustainable green finance programs will support environmentally friendly practices and investments in microfinance. Initiatives of CMA will foster clean energy, climate resilience, and sustainable agriculture, integrating sustainable finance principles into microfinance operations. This approach will contribute to environmental risk mitigation, support sustainable livelihoods, and foster economic growth through responsible practices.

Strengthen Responsible Lending and Monitor the Implementation of the Lending Guideline and Financial Sector Codes of Conduct in Addressing to Sector Risks and Priorities

The efforts have being made to enhance the implementation of the existing self-regulation including the Lending Guideline and Financial Sector Codes of Conduct…etc These guidelines provide a framework for responsible lending practices, including assessing borrowers' creditworthiness, enhancing lending ethics, setting reasonable price, and promoting transparency in the sector. By monitoring the implementation of these guidelines, the microfinance sector can ensure that lending institutions comply with industry best practices and regulatory requirements.

ធនាគារ/គ្រឹះស្ថាន ទទួលស្គាល់ពីតួនាទី និងការទទួលខុសត្រូវរបស់ខ្លួន ក្នុងកិច្ចការពារភពផែនដី និងបរិស្ថានបានល្អប្រសើរ និងភាពចំបាច់បំផុត ក្នុងការអនុវត្តទៅតា...

The objectives of this codes are: The rules of governing key terms of Standard Loan Contract are in the following: a) To promote effective, reliable,...

Initiated by the Cambodia Microfinance Association LG has been developed with support from international partners and investors. LG has been extended...