Projects in Partnership with Social Performance Task Fo...

The SPTF and CMA have been engaging extensively since 2020. This engagement has included the inclusion of adherence to the Cerise+SPTF CP Pathway in C...

Read more

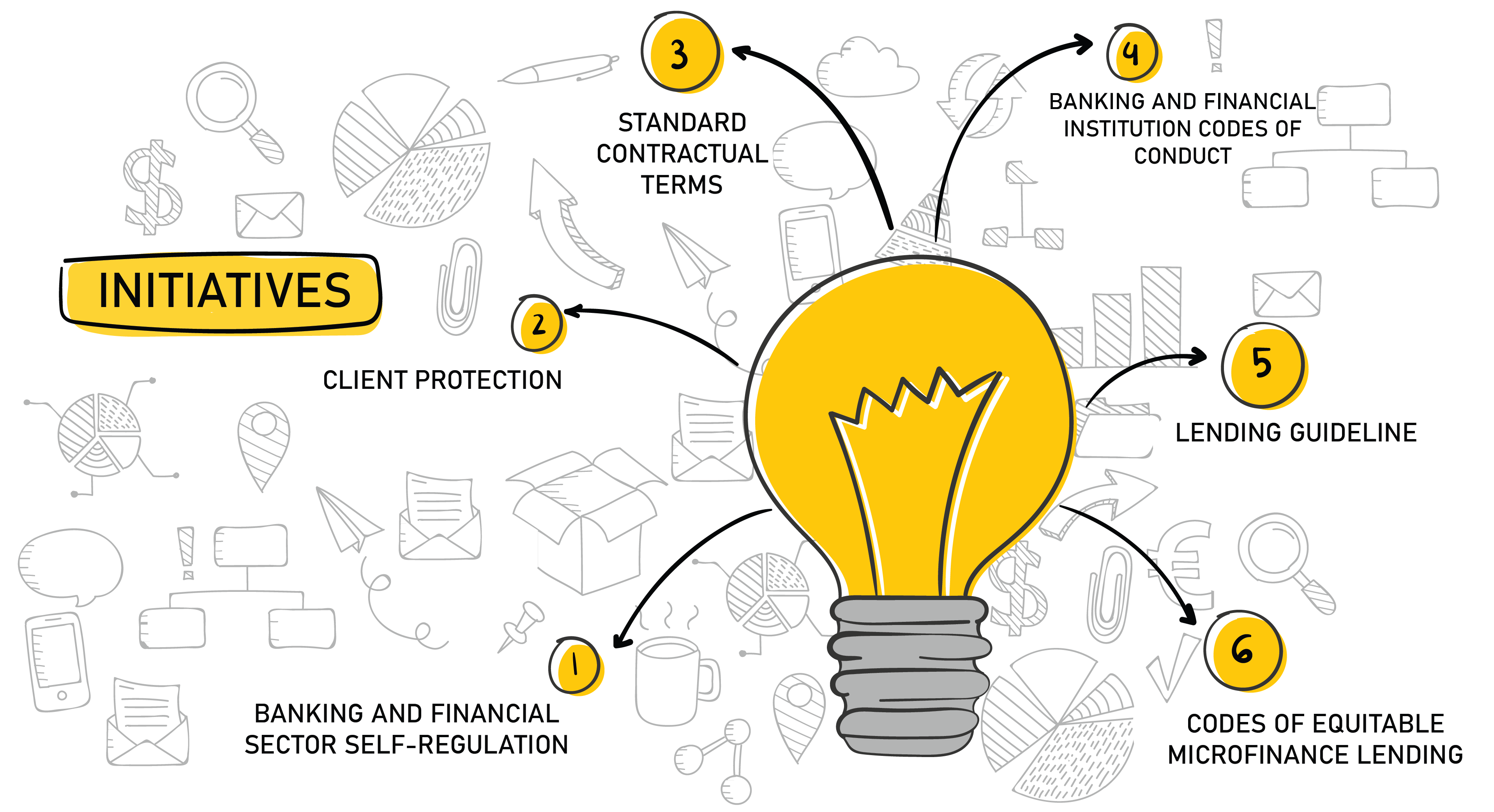

Sectoral Efforts and Projects to Strengthen Responsible Inclusive Finance in Cambodia

The sector efforts which has been initiated and lead by Cambodia Microfinance Association (CMA) and Association of Bank in Cambodia (ABC) with support from the National Bank of Cambodia (NBC) in strengthening Responsible Inclusive Finance in alignment to the National Financial Inclusion Strategies 2019 - 2025, contributing to the achievements of the Financial Sector Development Strategy 2016 - 2025 as following:

Banking and Financial Sector Self-Regulation

1. Standard Contractual Terms

The Standard Contractual Terms has been initiated and developed by the effort of the ABC and CMA in 2022 which the implementation scope covered the commercial bank, specialized bank, MDI, MFI, and Leasing company. The objective the Standard Contractual Terms is Contribute to client empowerment and increase customer protection as well as financial sector transparency.

The rules of governing key terms of Standard Loan Contract are in the following:

For more details please review it here:

2. Banking and Financial Institution Codes of Conducts (CoC)

The rules of governing key terms of Standard Loan Contract are in the following:

The objectives of this codes are:

This code applies to all members of the Association of Banks in Cambodia, Cambodia Microfinance Association, and Cambodia Association Fintech & Technology.

These codes of conduct covered 21 standards for BFI and Fintech company to follow. More details, please download from the following link:

3. The Lending Guideline (LG)

Initiated by the Cambodia Microfinance Association LG has been developed with support from international partners and investors. LG has been extended to whole Banking and Financial Sector on the 1st January 2022 after it has spent one full in 2021 to develop that both CMA Board and ABC Council approved the widen healthy practice to ensure the sustainability of the financial sector through including LG as the annex of the Banking and Financial Institutions Code of Conduct.

The objectives of the Lending Guideline are:

This Lending Guidelines is applicable to all lending institutions in Cambodia licensed by National Bank of Cambodia including commercial banks, specialized banks, microfinance deposit-taking institutions, non-deposit taking microfinance institutions, rural credit institutions, and leasing companies.

For more details on the Lending Guideline rule, please visit this link:

4. Codes of Equitable Microfinance Lending

The Code for Equitable Microfinance Lending ("the Code") has been approved and is to be implemented by all members of the Cambodian Microfinance Association (CMA) based on shared commitment and trust in accordance with the recommendations of the CMA’s Board of Directors (BoD). This Code aims to raise quality and strengthen equity in microcredit provision with a view to ensuring the sustainability of the microfinance industry in Cambodia, promoting financial system soundness and reducing poverty in line with the social mission of the microfinance sector and the strategic policy of the Royal Government of Cambodia.

This Code is an initiative of the CMA with the main purpose of complementing the professional operations of the Institutions in order to enhance the quality and equity of microfinance lending by ensuring:

For more details of the Codes of Equitable Microfinance Lending, please visit following link:

Other Client Protection Initiatives

1. Regional Workshop on Strengthening Capacity for the Betterment of Effective Branch Performance Management with Sustainability, Ethics and Professionalism

Initiated by the Cambodia Microfinance Association in 2022. This workshop targeted the managements level in the branch including district level branch manager, Provincial/regional level branch manager, and other branch managements levels. It has been conducted 6 times in the whole Cambodia. The objectives of this regional workshop are:

The key main topics to promote responsible lending are: Professional and ethical credit recovery, Improving the quality of responsible and ethical financial services, Responsible lending mechanism including the Codes of Conduct and the Lending Guideline.

2. Capacity Building of Loan Officiers Through Responsible Credit Training of the Institution of Banking and Finance

The objective To provide individual with the focuses of ethical principles and consumer protection which are the key to the sustainable financing and financial inclusion for their individual BFI specifically and for the Cambodian banking industry as the whole. It has been mandatory by the National Bank of Cambodia for all BFIs in Cambodia to send credit related staff including Branch Managers, Staff who originate, administrate, approve, monitor, and collect loan to join this course.

The main course outline are:

For more details please check the following link:

Link Document of Responsible Lending Program-IBF

3. Introducing the Responsible Lending Certification by the Institute of Banking and Finance. What is Responsible Lending, and who are the trainers? Find out more in our video

The SPTF and CMA have been engaging extensively since 2020. This engagement has included the inclusion of adherence to the Cerise+SPTF CP Pathway in C...

Initiated by the Cambodia Microfinance Association in 2022, the workshop targeted district level branch managers, provincial/regional level branch man...