CMA is committed to strengthening the ethical and professional capacity of human resources for sustainable operations of microfinance sector. To achieve this, our Training and Development Department implements five strategic objectives. These objectives focus on enhancing human resource development by providing targeted training programs, developing a comprehensive resource center for our members, offering access to informative materials, digital content, and e-courses relevant to the microfinance industry, and managing a talent pool program to connect skilled individuals with member institutions. Additionally, we actively promote professional and compliance standards within the HR sector and manage a staff development fund to support ongoing learning initiatives.

Training and Development Management

At the core of everything we do lies building human capital. We believe that training and development are essential bridges connecting an BFIs' current capabilities with its future aspirations. We equip employees from our member BFIs with the knowledge, skills, ethics, and professionalism they need to thrive. This translates to enhanced productivity, capabilities, and competency that ultimately contribute to the growth of individual institutions and the long-term sustainability of the entire sector. Each year, through our training programs and competency workshops, we empower roughly 1,650 staff members across core functions within our member BFIs.

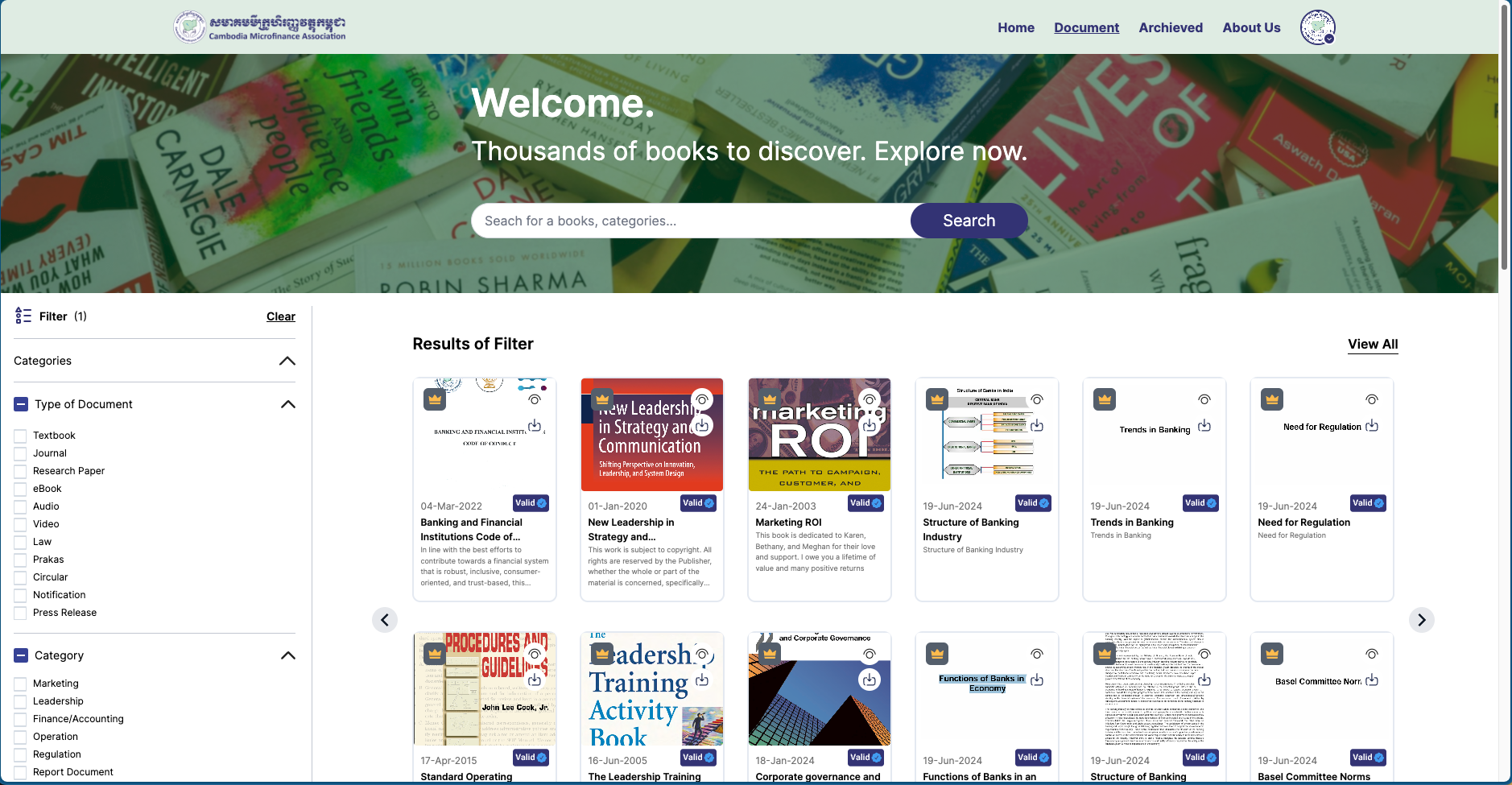

Resource Center (Knowledge Hub)

In responding to the need of our member BFIs, we are developing a resource center (Online Resource Hub, ORH) to provide a one-stop access to a variety of informative materials including laws, articles, guidelines, Prakas and some other important documents that matter to the sector. Up to this moment, more than 4,000 files of different types of documents are being uploaded and tested.

We expect that this helpful ORH offers easy access to information, allowing our members to learn independently, troubleshoot problems, and find solutions without relying on any external support within a timely and costless model. We anticipate launching this vital platform in the second quarter of 2024. The ORH also features a dedicated "Jobs in Microfinance" page. This page allowed job seekers to easily search for career opportunities within our member institutions, matching their skills and experience with available positions.

Talent Pool Program

We create this talent pool program to be served as a proactive and strategic approach to building a pipeline of qualified candidates for microfinance sector by attracting new talents from partner universities to fulfill the demand of Credit Officer and Compliance Officer roles of our member BFIs.

We equip them with specific knowledge and skill set of the position requirement and embed a strong consumer protection culture in practice. In addition, we also support our partner universities students with the chances to explore a wide range of potential employers and career paths in Microfinance Sector through preparing Career Fair so that they can learn about entry-level positions, internships, and graduate programs directly with CMA’s member institutions, giving them a well-rounded understanding of their options.

HR Professional and Compliance

We champion strong HR practices and compliance within the microfinance sector through creating a platform, namely Club and Core Group for HR professionals and compliance officers from our member microfinance institutions (MFIs). This platform fosters knowledge sharing, experience exchange, and discussion of best practices. It also provides crucial updates on labor law, banking law, and amendments to government regulations or Prakas to strengthen the human resource management, and compliance practice of MFIs more effectively and professionally. We arrange regular meetings, discussions and learning forums to leverage the efficiency of knowledge and information shared through this platform.

Manage and Implement Staff Development Fund

The rapid growth of the microfinance sector has led to a surge in staff numbers and staff recruitment which is a concern to the financial sector as a whole. This intense competition has somehow resulted in staff poaching among intra-financial institutions, finally causing high staff turnover rates in each institution. This staff movement is also hindering effective staff training and development programs, particularly impacting smaller and medium-sized MFIs.